|

| ||

|

← "Un-intelligent design" |

Return to Main Page

| "Asia's sad obsession with Nazi-ism" →

| TrackBack (1)

October 24, 2005

You are on the invidual archive page of Making China's numbers add up. Click Simon World weblog for the main page.

|

|

Making China's numbers add up

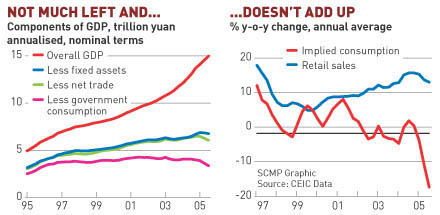

Last week China reported another stunning GDP growth number of 9.4%. But as we've found numerous times before, the numbers underlying the GDP calculation don't add up. Either China's consumers went on strike or fixed asset investment has been over-estimated. Jake van der Kamp is on the case and reaches an unsurprisingly but important conclusion (below the jump). Other reading Brad Setser calls it China's crazy numbers.

When the National Bureau of Statistics in Beijing occasionally admits that the figures it publishes are not entirely reliable, I know exactly what it means. We had another case of it last week with the release of third-quarter provisional statistics for gross domestic product. Strong investment and robust private consumption pushed economic growth to 9.4 per cent in the quarter, said the bureau.Determining economic statistics is notoriously difficult at the best of times. But such wildly inaccurate numbers make scary reading. Why? If you're steering the world's fourth largest ship and your navigational data is "rubbish", you're going to end up doing plenty of damage not just to yourself but everyone around you. posted by Simon on 10.24.05 at 09:51 AM in the China economy category.

Trackbacks:

TrackBack URL for this entry: http://blog.mu.nu/cgi/trackback.cgi/123742 Send a manual trackback ping to this post. Is China's "Economic Miracle" a Lie? Excerpt: A growing number of macroeconomists seem to think so... Weblog: A Stitch in Haste Tracked: October 26, 2005 12:48 AM

Comments:

Very interesting. I wonder whether inventories might also be a lot bigger than expected? posted by: HK Dave on 10.24.05 at 10:53 AM [permalink]I think inventories are a relatively minor part of GDP, so even if they were widely different the impact on the larger number would be small. posted by: Simon on 10.24.05 at 10:56 AM [permalink]Don't forget that what China tells the world, tells its people and tells its officials are three entirely different things. I have no doubt that the Chinese officials know exactly how much they are really spending/growing/stealing/etc... I don't think navigation or bad finacial data is as real a danger as these figures express. The rampant corruption on the other hand, is another story entirely. posted by: DudeMiester on 10.24.05 at 03:47 PM [permalink]It is very surprising to me that none have carefully checked the data. The data of the fixed investment used includes private and government investment, and the amount of the government consumption is the government spending, which also includes government investment. The fact is that the government investment has been subtracted twice. How can the remainder be equal to the private consumption, when you subtract government investment twice?! posted by: Quan Song on 10.27.05 at 04:19 AM [permalink]Your calculation is totally wrong and misleading because you doesn't understand the terminologies used by the Chinese statistical authorities. Investment expenditure you use is so-called the completed investment in fixed assets, which is not gross capital formation in the national accounts. Investment in fixed assets involves double accountings. The difference between the completed investment in fixed assets and capital formation is much bigger than that between retail trade and final consumption. The Chinese statistical authority has never released GDP components quarterly, which are only available in yearly figures several months after the year. The problem with China GDP statistics is not "adding up", which is easy to do, rather is whether they reflect the performance of the Chinese economy. Professor Thomas Rawski from University of Pittsburgh has discussed several issues about China GDP statistics (www.pitt.edu/~tgrawski/papers2001/gdp912f.pdf). posted by: Leilei on 10.27.05 at 12:01 PM [permalink]The problem with China GDP statistics is not "adding up", which is easy to do, rather is whether they reflect the performance of the Chinese economy.Either way, there's a big problem. posted by: Simon on 10.27.05 at 12:06 PM [permalink]At the base, China does not have an accounting system that clearly distinguishes between value-added and intermediate consumption at the micro level. So, the problem goes even deeper than the analysis here. Bottom up compilation is not coherent. posted by: parisdude on 11.16.05 at 10:25 PM [permalink] |

|