|

| ||

|

August 09, 2005

You are on the invidual archive page of Who owns forex reserves?. Click Simon World weblog for the main page.

|

|

Who owns forex reserves?

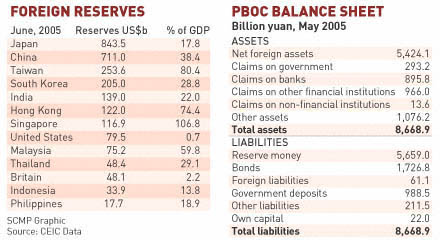

Jake van der Kamp in the SCMP explains central bank balance sheet basics. Lest you think that is incredibly boring, Jake demonstrates that the "People's" Bank of China's massive foreign reserves (and those of many countries) is mostly owed to banks and private entities, not the Government (and thus, in theory, the people). Happily, there's one place that is an exception to this rule. Read on to find out where... Mainland's soaring foreign reserves a treasure chest of fool's gold My colleague, Mark O'Neill, who is based in Shanghai, contributed an interesting column yesterday about how the authorities in the mainland are deliberating what best they can do with their massive foreign reserves.

Trackbacks:

TrackBack URL for this entry: http://blog.mu.nu/cgi/trackback.cgi/107447 Send a manual trackback ping to this post.

Comments:

Ok, you win. That was fascinating. I never thought about central bank accounting before but you are absolutely right. Very interesting stuff indeed. posted by: RP on 08.10.05 at 05:08 AM [permalink]Who says it's a dismal science? posted by: Simon on 08.10.05 at 09:19 AM [permalink]Who indeed? posted by: RP on 08.12.05 at 12:10 AM [permalink] |

|