|

| ||

|

July 14, 2005

You are on the invidual archive page of The coming China crunch. Click Simon World weblog for the main page.

|

|

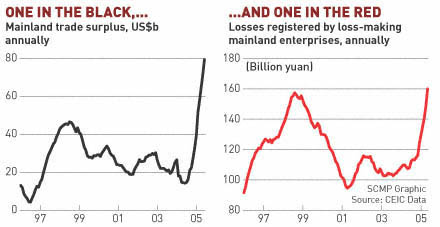

The coming China crunch

Jake van der Kamp in the SCMP explains, after the usual caveat about the reliability of Chinese stats, why China's export boom may be coming to an end (charts below the fold): In just one year, it [China's trade surplus] has shot up from US$14.2 billion to US$80 billion a year. It looks like a big number, but it is not necessarily really that big. It amounts to 4.5 per cent of gross domestic product, which is sizeable but not huge, and the figure was actually higher in 1998. To put it in further contrast, the United States runs a trade deficit nine times as large. What makes it unusual, however, is how suddenly it has materialised. The superficial reason for it is that the mainland's export growth is still running at more than 30 per cent year on year while its import growth has fallen to much lower levels.Not to mention a further drop in the pressure to revalue the yuan...at least for economic reasons. You can take this analysis further. China's economic growth has held up despite the Gvoernment's efforts at engineering a slow down. At the same time there has been a rise in protectionist pressures in major export markets such as the US and EU, especially in textiles. If Chinese manufacturers have ramped up production to beat the quotas and economic pressure, you can expect not just an export slowdown but a far broader one. China has accounted for 25% of global GDP growth in the past 5 years, a major buyer of US dollars and bonds and a key driver in Japan's nascent economic recovery. By the way, you'll be please to know China has officially completed the transition to a socialist market economy.

Trackbacks:

TrackBack URL for this entry: http://blog.mu.nu/cgi/trackback.cgi/99706 Send a manual trackback ping to this post.

Comments:

If the bottom really drops out of the US housing market and people end up holding mortgages worth more than their properties that might be enough to make China's export market go splang without any further protectionist measures being required. At which point our esteemed congressmen could forget about textile quotas and a the deluge of teddy bears and concentrate their full attention on Chinese buyouts of mediocre American companies. The mind quakes. Say, doesn't it help to decrease the trade deficit if we sell off our bum companies to the Chinese? It seems to me we finally found the product we can export back! posted by: Will on 07.14.05 at 03:32 PM [permalink] |

|