|

| ||

|

May 24, 2005

You are on the invidual archive page of Blame Japan. Click Simon World weblog for the main page.

|

|

Blame Japan

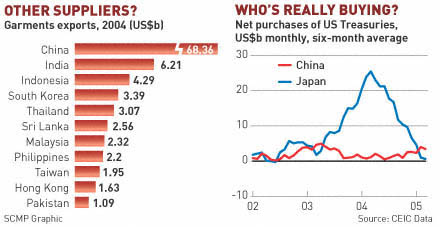

It seems churlish for China's Vice Premier to visit Japan urging an improvement in Sino-Japanese ties one day, only to stand up Japanese PM Koizumi the next. But that is not today's topic. Instead I present Jake van der Kamp's lovely fisking of "know-it-all economist" Paul Krugman (sorry, Saru) on America's alleged addiction to Chinese dollar purchases. Read to the end, where Jake reveals the real buyer... "In other words, the US has developed an addiction to Chinese dollar purchases and will suffer painful withdrawal symptoms when they come to an end."I will merely add that recently we've seen a stronger US dollar and rising pricings of US Treasury bonds despite this decline in official offshore purchases. So will we soon hear pleas for Japan to allow the Yen to appreciate, for Japan to abandon it's unofficial currency peg (where the BoJ intervenes to prevent Yen strength)? Will protectionist measures be taken against Japan for such unfair currency manipulation? Oh, but I hear you say, Japan's economy isn't doing as well as China's. So what. If American politicians want someone to blame, it's Japan. Don't hold your breath waiting for the change.

Trackbacks:

TrackBack URL for this entry: http://blog.mu.nu/cgi/trackback.cgi/82492 Send a manual trackback ping to this post. |

|