|

| ||

|

← "Waste not" |

Return to Main Page

| "Laws of linkage" →

October 06, 2004

You are on the invidual archive page of Trading places. Click Simon World weblog for the main page.

|

|

Trading places

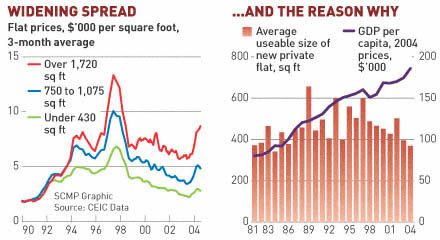

There's another sign that property is hot again in HK: this is my second entry on the topic in two days (the first was on the new bubble). Jake van der Kamp in the SCMP notes an interesting discrepency opening up in Hong Kong's property market. Prices of larger flats (those over 1700 sq feet) have seen outsized gains compared to smaller ones. The chart is in the extended entry for your perusal. In 1990 the prices of all flats moved approximately in tandem. Since then and particularly in the past year or so the gap between the bigger and smaller flats has grown - they still move up and down together, but the spread between them grows ever larger. Larger flats are now 3 times the per square foot price of the smallest ones, a massive gap. As van der Kamp points out, these are average figures. He dismisses the value of premium flats because of this, however especially in a rising market, the top end of the premium market is going to drag the average of that class higher still. Nevertheless his main point remains valid. More interestingly is his question as to why this should be so. The second chart shows that Hong Kong has become a much wealthier place in the past 20 years; real per capita GDP has doubled in that time to US$24,000 per person. At the same time the average usable size of new private flats has actually declined slightly. Today the average size of new flats sold in HK is 370 sq feet of usable area. People with US$24,000 each of economic value do not want to live in flats no bigger than a closet. Who is to blame? I would have thought it was the property developers whom insist on building such tiny places. But apparently not. It is the planning regulators that decide the size of units in each approved development. So civil servants, many of whom no doubt live in substantially larger units than this 370 sq foot average, determine that Hong Kongers must continue to live in tiny flats. Because that's how things have always been done. Perhaps if these civil servants were made to actually live in the apartments they approve, things would be different. In the interim the market has found its own solution: the price of bigger flats is going up faster than those of smaller ones. With the long lead times on new property developments, the planners need to start approving larger flats fast, or they'll have a middle-class riot on there hands when the price of bigger places becomes completely out of reach.

Trackbacks:

TrackBack URL for this entry: http://blog.mu.nu/cgi/trackback.cgi/48773 Send a manual trackback ping to this post. Simon's E. Asia Briefing: 2004-10-27 Excerpt: The following is a digest of highlights from the past month's Asia by Blog series over at simonworld.mu.nu. The round-up has four key areas of focus: China, Taiwan & Hong Kong (Politics, Economy & lifestyle, History sport & culture, Information), Korea... Weblog: Winds of Change.NET Tracked: October 27, 2004 10:08 AM

Comments:

Jake has comemnted on this before, and predicted about 2 years ago that demand for larger flats would drive the prices of these flats proportionately more than for the normal rabbit hutch apartments. My recent exploration of the rental market bears this out - the price for a 1765 sq. ft. flat in the development I have been focussing on (and I have looked at 20 or more flats in the development) is about two thirds higher than for a 1350 sq. ft. flat in the same development though it less than one third larger. posted by: fumier on 10.06.04 at 06:08 PM [permalink] |

|